The Evolution and Current Landscape of China's Machinery Exports

The Evolution and Current Landscape of China's Machinery Exports

The development of China's machinery exports serves as a microcosm of its economic rise over the past three decades and a testament to its evolving role in global manufacturing. The journey can be summarized as a transition from non-existence to prominence, from low-end to high-end, culminating in its current status as an indispensable core force in the global machinery supply chain.

Phases of Development

1. The Nascent Stage (1990s and earlier)

-

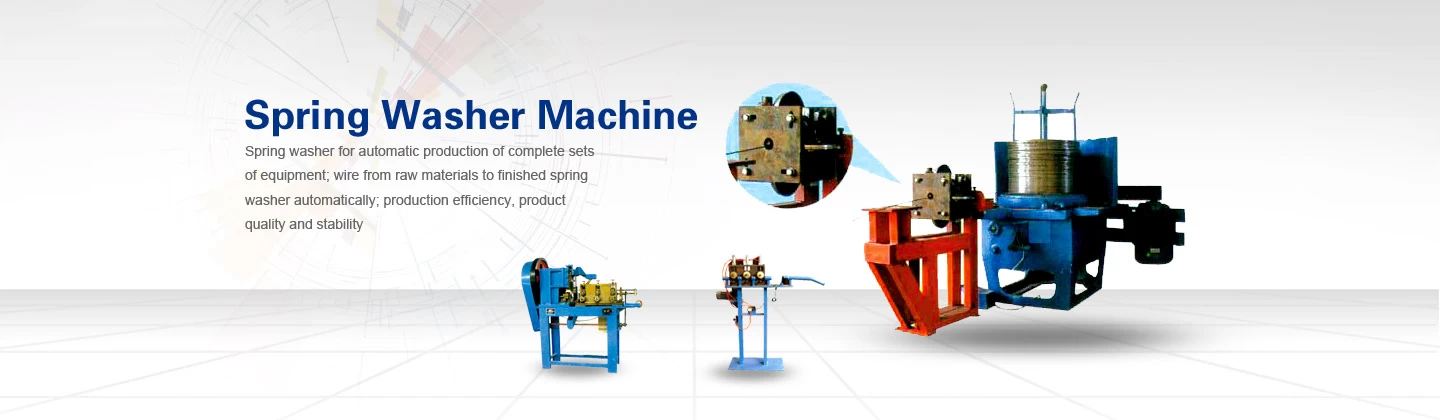

Product Range: Exports were dominated by labor-intensive, low-value-added goods such as simple metalworking tools, hand tools, basic components, and Original Equipment Manufacturing (OEM) for foreign brands.

-

Competitive Edge: The core advantage was extremely low labor and land costs. Products were generally of lower quality and technological sophistication, competing primarily on price in the international market.

-

Market Position: China acted as a market "follower" and "supplement," with small market share and weak brand influence.

2. The Rapid Expansion Phase (2000 - 2010)

-

Key Catalyst: Accession to the World Trade Organization (WTO) in 2001 was a pivotal turning point, granting China better market access and significantly reducing trade barriers.

-

Product Upgrading: The export portfolio expanded rapidly to include general mechanical equipment, electrical equipment, household appliances, and construction machinery (e.g., cranes, excavators).

-

Model Shift: While OEM continued, domestic brands (e.g., Haier, Gree, Sany, XCMG) began to emerge and venture into direct exports.

-

Explosive Growth: Export value experienced exponential growth, rapidly propelling China to become one of the world's largest exporters of machinery products.

3. The Transformation and Upgrading Phase (2010 - Present)

-

New Drivers: Traditional cost advantages gradually diminished. Technological innovation, economies of scale, a complete industrial ecosystem, and continuously improving quality became the new core competencies.

-

Move Upstream: The export structure optimized significantly, with a notable increase in the share of high-tech, high-value-added products, such as:

-

New Energy Vehicles (NEVs): China is now the world's largest producer and exporter of NEVs.

-

Solar PV Panels & Wind Turbines: It holds a dominant position in the global green energy transition.

-

High-End Construction Machinery: Large, intelligent, and new-energy-powered excavators, loaders, and tunnel boring machines are being exported worldwide.

-

Industrial Robots & CNC Machine Tools: Rapidly improving technological levels are driving increased exports.

-

-

The "New Three": In recent years, electric vehicles, lithium-ion batteries, and solar cells—dubbed the "New Three"—have become the new name cards and growth engines for Chinese manufacturing exports, showcasing its strength in high-end manufacturing.

Current Status and Key Data

-

Global Standing: Since 2009, China has been the world's largest trader of mechanical goods and has maintained this position. Machinery and electronic products consistently account for over half of China's total exports.

-

Export Structure: A comprehensive export system with a complete industrial chain has been established, covering virtually all machinery categories, from basic components to large complete sets of equipment.

-

Market Distribution: Exports are diversified, targeting both developed markets like Europe and the US, as well as countries involved in the "Belt and Road" initiative and other developing nations. Southeast Asia, the Middle East, and Europe are key markets.

Core Competitive Advantages

-

Complete Industrial Cluster: China boasts the world's most comprehensive industrial system. Nearly all components for machinery manufacturing can be sourced domestically, drastically reducing production costs and supply chain risks while improving responsiveness.

-

Economies of Scale and Cost Control: A vast domestic market and enormous production scale dilute R&D and manufacturing costs, giving Chinese products a high cost-performance ratio internationally.

-

Technological Innovation and Industrial Upgrading: Sustained, massive investment in R&D and policy support have enabled the continuous move up the value chain, with breakthroughs achieved in numerous sectors.

-

Robust Infrastructure and Logistics Network: Efficient ports, railways, and highways facilitate the rapid transportation and export of large machinery products.

Challenges

-

International Trade Frictions: Trade protectionist measures adopted by some countries, such as tariff hikes and technical barriers, pose challenges to exports.

-

Competition in Core Technologies: Gaps remain compared to manufacturing powerhouses like Germany, Japan, and the US in some extreme high-end fields (e.g., top-tier precision CNC machine tools, advanced semiconductor equipment, certain high-end bearings and materials).

-

Brand Influence: While many strong brands exist, overall global brand recognition and premium pricing power still lag behind top international brands (e.g., Caterpillar, Siemens, Fanuc).

-

Rising Costs: Increasing costs for labor, land, and other factors are eroding the traditional price advantage.

Conclusion

The evolution of China's machinery exports is a history of leapfrogging from "quantity" to "quality." It has successfully transformed from cost-driven exports reliant on cheap labor to comprehensive advantage-driven exports powered by a complete industrial chain, technological innovation, and economies of scale.

Looking forward, China's machinery exports will continue to advance toward higher-end, intelligent, and green development. Its role in the global industrial chain will deepen from being a "manufacturing giant" to a "manufacturing powerhouse" and an "intelligent manufacturing powerhouse," actively participating in and reshaping the competitive landscape of global high-end manufacturing.